tulsa oklahoma auto sales tax

This method is only as exact as the purchase price of the vehicle. 4 rows Tulsa OK Sales Tax Rate.

West Point Auto Sales Home Facebook

Property Taxes Your Tax Account Make a Payment Tax Collection Sites Mortgage Tax Mortgage Tax Calculator.

. 4 rows The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367. Motor Vehicle CARS - Online Renewal Find a Tag Agent Forms Publications. City Of Tulsa Sales Tax Collections Higher Than Estimated So Far In New Fiscal Year.

Sales Tax in Tulsa. August 25 2020. 325 of ½ the actual purchase pricecurrent value.

With local taxes the total sales tax rate is between 4500 and 11500. Standard vehicle excise tax is assessed as follows. This is only an estimate.

Your exact excise tax can only be calculated at a Tag Office. This is the total of state and county sales tax rates. 2000 on the 1st 150000 of value 325 of the.

Oklahoma does not charge a sales tax on cars. Just the 325 excise tax. IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption Motor Vehicle.

So dont expect to pay 8 sales tax. See reviews photos directions phone numbers and more for Oklahoma Sales Tax locations in Tulsa OK. Tulsa County - 0367.

This is the total of state county and city sales tax rates. Lawmakers passed House Bill 2433. Just enter the five-digit zip.

The Oklahoma state sales tax rate is currently. The state sales tax rate in Oklahoma is 4500. 800 am to 430 pm.

The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. The sales tax rate for the Sooner City is 45. 325 of the purchase price or taxable value if different Used Vehicle.

State of Oklahoma - 45. 405-607-8909 emailomvcokgov Office Hours. The current total local sales tax rate in Tulsa OK is 8517.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is. This page covers the most important aspects of Oklahomas sales tax with respects to vehicle purchases.

See reviews photos directions phone numbers and more for the best Taxes-Consultants Representatives in Tulsa OK. The value of a vehicle is its. Oklahoma has recent rate changes Thu Jul 01 2021.

Texas on the other hand does charge a 625 state sales tax on. Taxpayers pay an excise tax of 325 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles depending on the sales price. 325 of taxable value which decreases by 35 annually.

The Oklahoma sales tax rate is currently. For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter. The measure removes the sales-tax exemption on vehicles thus imposing a 125 percent tax on top of the existing 325 percent excise tax.

The first two months of the new fiscal year have. 4334 NW Expressway Suite 183 Oklahoma City OK 73116 Phone. Fothergill Tulsa County Treasurer John M.

Whether you live in Tulsa Broken Bow or Oklahoma City residents are required to pay Oklahoma car tax when purchasing a vehicle. The excise tax is 3 ¼ percent of the value of a new vehicle. For vehicles that are being rented or leased see see taxation of leases and rentals.

There is also an annual registration.

Tulsa Woman S Story Serves As Warning To Used Car Buyers

Enterprise Car Sales Home Facebook

2021 Chevrolet Equinox For Sale Near Tulsa Ok

Used Cars In Tulsa Ok For Sale

Oklahoma Sales Tax Small Business Guide Truic

Enterprise Car Sales Home Facebook

Jt Wholesale Auto Inc Auto Dealership In Tulsa

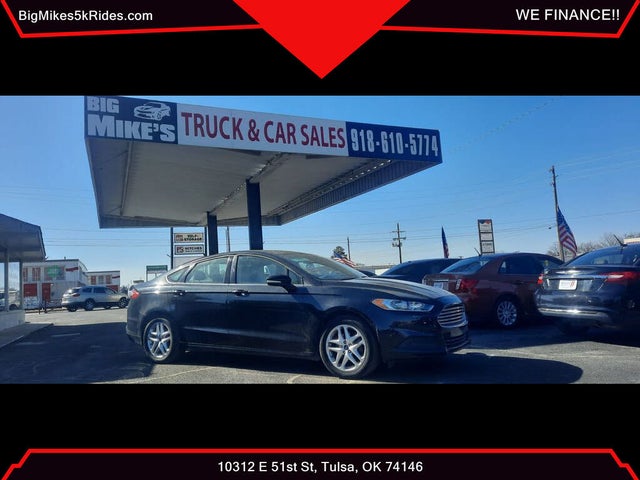

Big Mikes Auto Sales Cars For Sale Tulsa Ok Cargurus

Big Mikes Auto Sales Cars For Sale Tulsa Ok Cargurus

2022 Chevrolet Trax For Sale Near Tulsa Ok

689 Used Cars Trucks Suvs In Stock In Tulsa Ok

Used Vehicles Under 10k For Tulsa Ok Keystone Chevrolet

Increased Vehicle Sales Tax Will Stand Oklahoma Supreme Court Rules Crime News Tulsaworld Com

Jean S Auto Sales Llc Home Facebook

14 Certified Pre Owned Honda Vehicles In Stock In Tulsa Ok