main street small business tax credit 1

And we get it. You may apply 13 of.

7 Insanely Awesome Write Offs That Solopreneurs Need To Know

The Main Street Small Business Tax Credit is calculated based on monthly full-time employees.

. Ad Find out what tax credits you might qualify for and other tax savings opportunities. Helped 225000 Small Businesses since 2007. Include your Main Street Small Business Hiring Credit FTB 3866 form to claim the credit.

Your Main Street Small Business Tax Credit will be available on April 1 2021. 2021 Main Street Small Business Tax Credit II CDTFA CAgov Your tentative credit amount under 2021 Main Street II is 50000 minus 10000 or 40000. That said ask any of the 2000 businesses weve helped claim over 100M in the last year and theyll tell you.

Ad All Major Tax Situations Are Supported for Free. The cap on the credit is 150000 for each qualified small business employer. The Main Street tax credit incentive program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to eligible downtown organizations.

Get the tax answers you need. On or after January 1 2020 and before January 1 2021 a Main Street Small Business Tax Credit is available to a. You will be able to apply your credits against your sales and use tax liabilities for reporting periods starting with.

The law offers a tax credit to many California companies that had 100 or fewer employees at the end of 2019 and then experienced at least a 50 drop in gross receipts as. Ad Get a Decision within 24 Hours and Funded in as Fast as 72 Hours. Include your Main Street Small Business Hiring Credit FTB 3866 form to claim.

Main Street Small Business Tax Credit For the taxable year beginning. Start Your Tax Return Today. GO-Biz offers a range of.

Talk to a 1-800Accountant Small Business Tax expert. Each employer is limited to no more than 100000 of this credit. Get the tax answers you need.

Credit Amount For California Main Street Small Business Tax Credit The amount is 1000 for each net increase in the qualified employees measured after the monthly full-time. Governors Office of Business and Economic Development GO-Biz Serves as Californias single point of contact for economic development and job creation efforts. Talk to a 1-800Accountant Small Business Tax expert.

How to Claim File your income tax return. Tax credits do sound a little far-fetched at first. 7 Billion Already Delivered.

Provide the confirmation number received from CDTFA on your. Max refund is guaranteed and 100 accurate. What is the maximum amount of credit allowed per each qualified small.

Free means free and IRS e-file is included. The California Competes Tax Credit Main Street Small Business Tax Credit Opportunity Zones and other like programs provide opportunities to Californias small businesses to grow. If credits were received prior for the first version of the mainstreet tax credits they would be included in the.

File your income tax return. No Matter What Your Tax Situation Is TurboTax Has You Covered. Ad Find out what tax credits you might qualify for and other tax savings opportunities.

Ad Find Business Expenses You May Not Know About And Keep More Of The Money You Earn. 11 hours agoAmericas largest and leading small-business association issued its biennial voting records this week and applauded Wyoming lawmakers for being true friends of Main.

Ecommerce Tax Deductions You Need To Consider For Your Business Clickfunnels

Quicken Home Business Personal Finance 1 Year Subscription Windows Digital Personal Finance Business Tax Deductions Business Credit Cards

How To Get A Business Mileage Tax Deduction Small Business Sarah Tax Deductions Business Tax Deductions Business Tax

Give Us A Call 612 440 8651 Send Us A Message Info Abdulghaffar Com Opening Hours Mon Friday 8am 5p Bookkeeping Services Accounting Services Bookkeeping

Free 21 Sample Business Introduction Letter Templates In Pdf Ms Word Pages Google Docs

How To Do Holiday Marketing Campaign On A Budget Imperfect Concepts Tax Write Offs Small Business Tax Business Tax

22 Money Saving Small Business Tax Deductions 2022

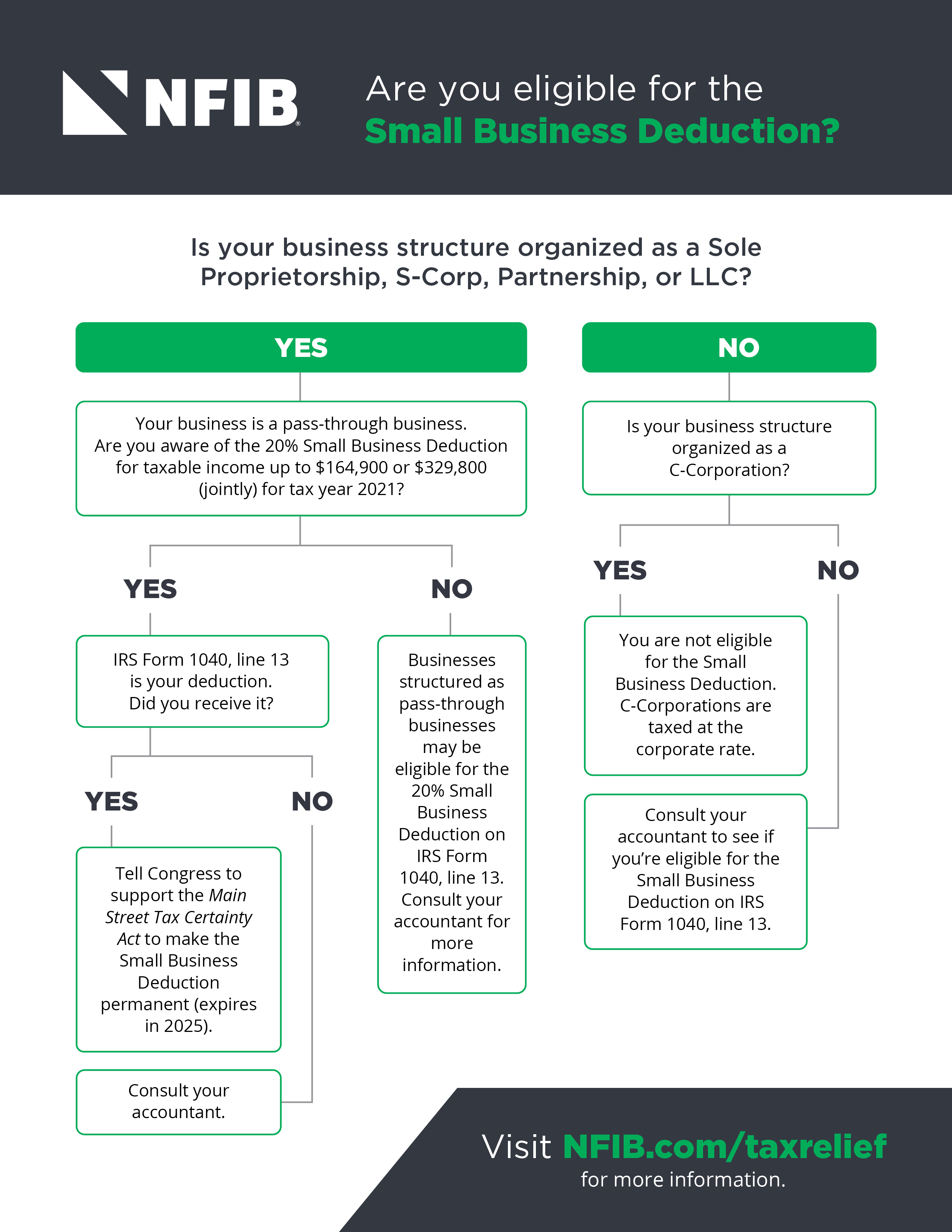

Small Business Survival Protect Small Business From Taxes Nfib

Taxes Can Be Very Complex And Smallbusinesses Often Run Into Difficulties When It Comes To Knowing All That They Nee Tax Time Payroll Taxes Business Expense

How To Write A Perfect Business Plan In 9 Steps

Small Business Tax Write Offs Imperfect Concepts

Lexington Vriginia Mainstreet Small Town America Places To Go San Luis Obispo County

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

J K Lasser S Small Business Taxes 2022 Your Complete Guide To A Better Bottom Line Wiley

Workers Compensation Audit In Norcross Business Tax Audit General Liability