dependent care fsa income limit

These limits apply to both the calendar year January 1December 31 and the plan year July 1June 30. 10 as the annual contribution limit rises to 2850 up from.

Child Care Tax Savings 2021 Curious And Calculated

The maximum amount you can contribute to the Dependent Care FSA depends on your marital status your tax-filing status and income.

. Employers can choose whether to adopt the increase or not. 5000 per year per family if your 2021 earnings were less than 130000 3600 per year 300 per month per family if your 2021 earnings were 130000 or more Your earned income for the plan year or Your spouses earned income for the plan year. Dependent Care FSA Eligible Expenses Care for your child who is under age 13 Before and after school care Babysitting and nanny expenses Daycare nursery school and preschool Summer day camp.

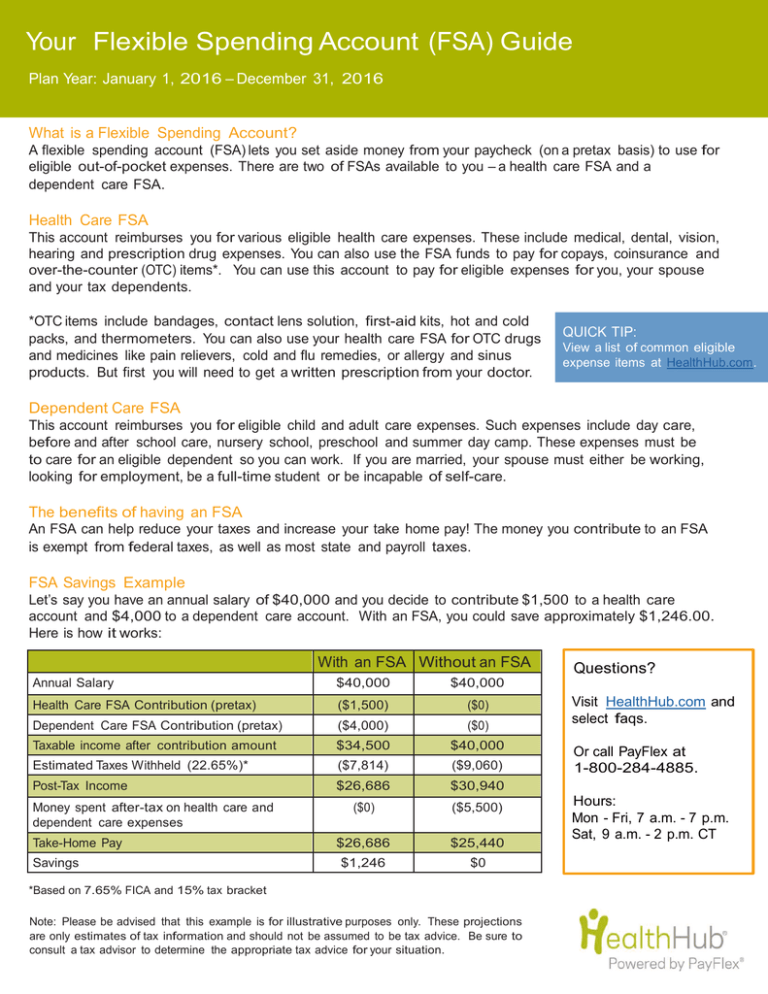

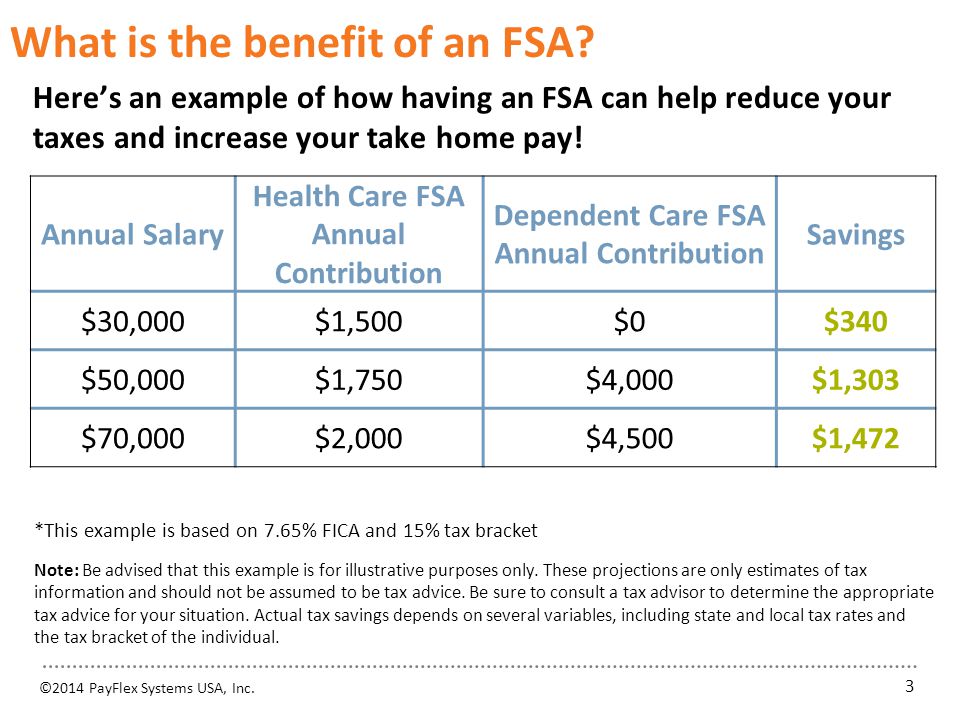

The minimum annual election for each FSA remains unchanged at 100. You spouse 2 cant contribute to spouse 1s DCFSA. Since FSA contributions are pre-tax you save money by not paying taxes on your contributions.

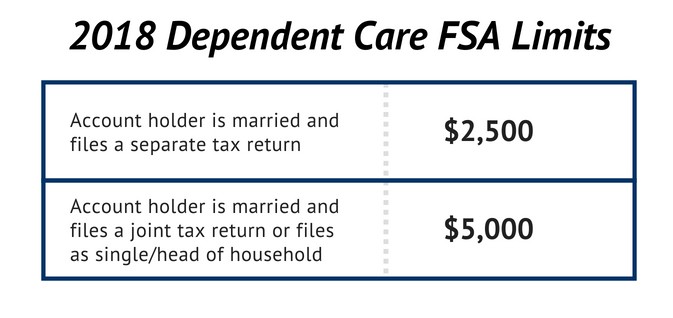

If you are married and file separate tax returns the most you can contribute is 2500. The maximum overall contribution for both spouses combined is still 5000. I know that dependent care fsa has a maximum contribution of 5000 for a married filing joint couple if the earned income for each of them is more than 5000.

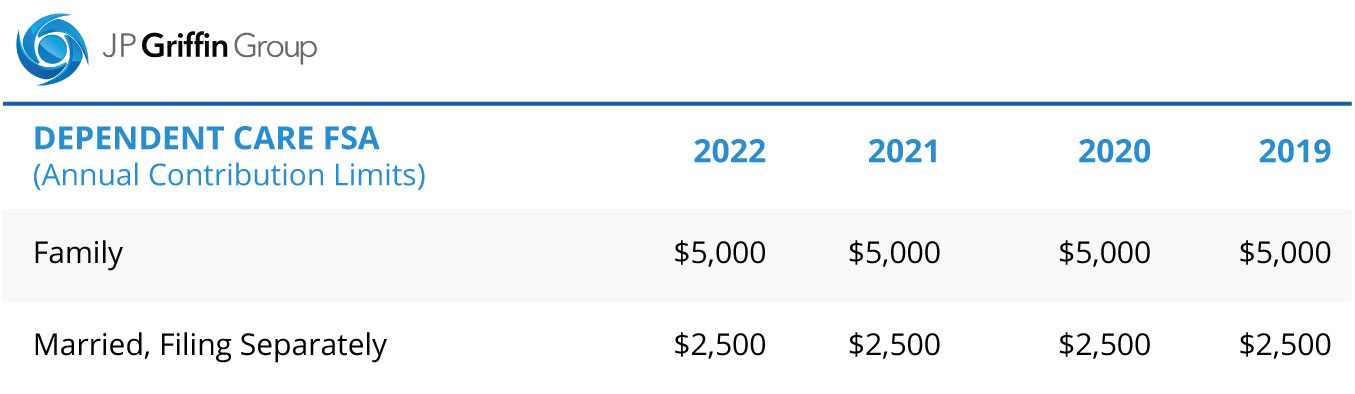

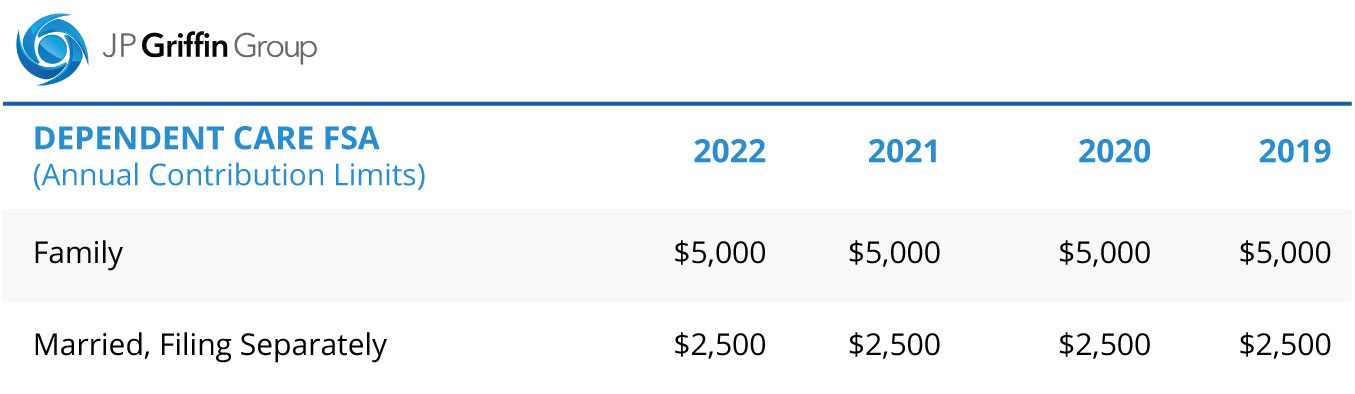

Dependent Care Flexible Spending Accounts FSAs also known as Dependent Care Assistance Programs DCAP allow you to use pre-tax dollars to pay for qualified dependent day care expenses to enable you to work. The limit will return to 5000 for 2022. Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals filing separately 26 USC.

It remains at 5000 per household or 2500 if married filing separately. Maximum Annual Dependent Care FSA Contribution Limits. However the combined employer and employee contributions cannot exceed the IRS limits the maximum annual amount is 5000 per year or 2500 if you are married and file separate returns.

The guidance also illustrates the interaction of this standard with the one-year increase in the exclusion for employer-provided dependent care benefits from 5000 to 10500 for the 2021 taxable year under the American Rescue Plan Act. The money you contribute to a Dependent Care FSA is not subject to payroll taxes so you end up paying less in taxes and taking home more of your paycheck. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov.

Parents can use their Dependent Care FSA to cover nanny expenses provided they care for young children in the home so that both parents can work. ARPA increased the dependent care FSA limit for calendar year 2021 to 10500. The 2022 dependent care fsa contribution limits decreased from 10500 in 2021 for families and 5250 for married taxpayers filing separately.

For 2022 and beyond the limit will revert to 5000. For example if an employer has elected a 2000 contribution to a Dependent Care FSA employees may only contribute up to an additional 3000. Conduct 2019 nondiscrimination testing for your population early in the year Spring 2019 is a great time.

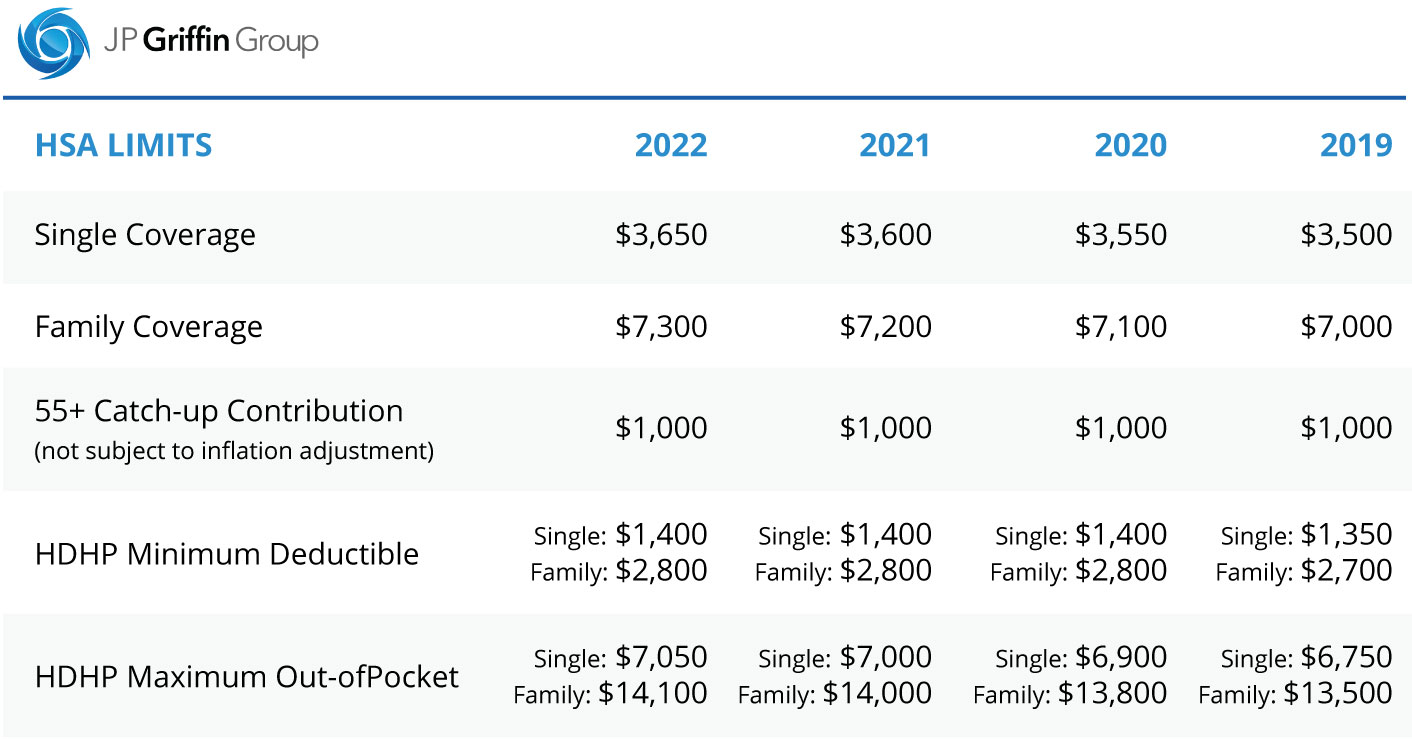

The health FSA contribution limit is established annually and adjusted for inflation. The 2021 dependent care FSA contribution limit. That means for a married couple each parent can contribute 2500 to their own Dependent Care FSA for a total of 5000.

This means that an employee can set aside 10500 in a dependent care fsa if their employer has one instead of the normal 5000. Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals filing separately 26 USC. This amount returns to 5000 for 2022.

Filing separately your annual limit is 2500 per each spouse. The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022. Ensure that the Eligibility and Benefits tests are also conducted.

The 2021 dependent-care fsa contribution limit was increased by the american rescue plan act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing separately.

Only spouse 1 can contribute through a section 125 cafeteria plan offered by employer 1. 125i IRS Revenue Procedure 2020-45. As with the standard rules the limit is reduced to half of that amount 5250 for married individuals filing separately.

The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money. If you have a dependent care fsa pay special attention to the limit change. As more companies adopt the FSA.

The 2022 fsa contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. March 30 2021 839 AM. If your spouse has a Dependent Care FSA through his or her employer and you file a joint tax return your combined deposits cannot exceed 5000.

For the 2021 income year it is 2750 26 USC. Parents and guardians can save a significant amount of money when they use an FSA rather than after-tax dollars to pay for dependent-care expenses. ARPA automatically sunsets the increased dependent care FSA limit at the end of 2021.

In these cases nannies meet the essential qualifying criteria and charges easily exceed the 5000 limit. However keep in mind that by claiming an at-home nanny you then become a household employer. Spouse 2 can contribute to a separate DCFSA at spouse 2s employer if offered.

Filing jointly your annual limit is. Single file as head of household 5000 Married file a joint return 5000 Married file separate returns 2500. Limit the Dependent Care FSA benefit to only those considered NHCEs salary under 125000 for 2019 not an officer or greater than 5 owner.

If you are married and file separate tax returns the most you can contribute is 2500.

Why You Should Consider A Dependent Care Fsa

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

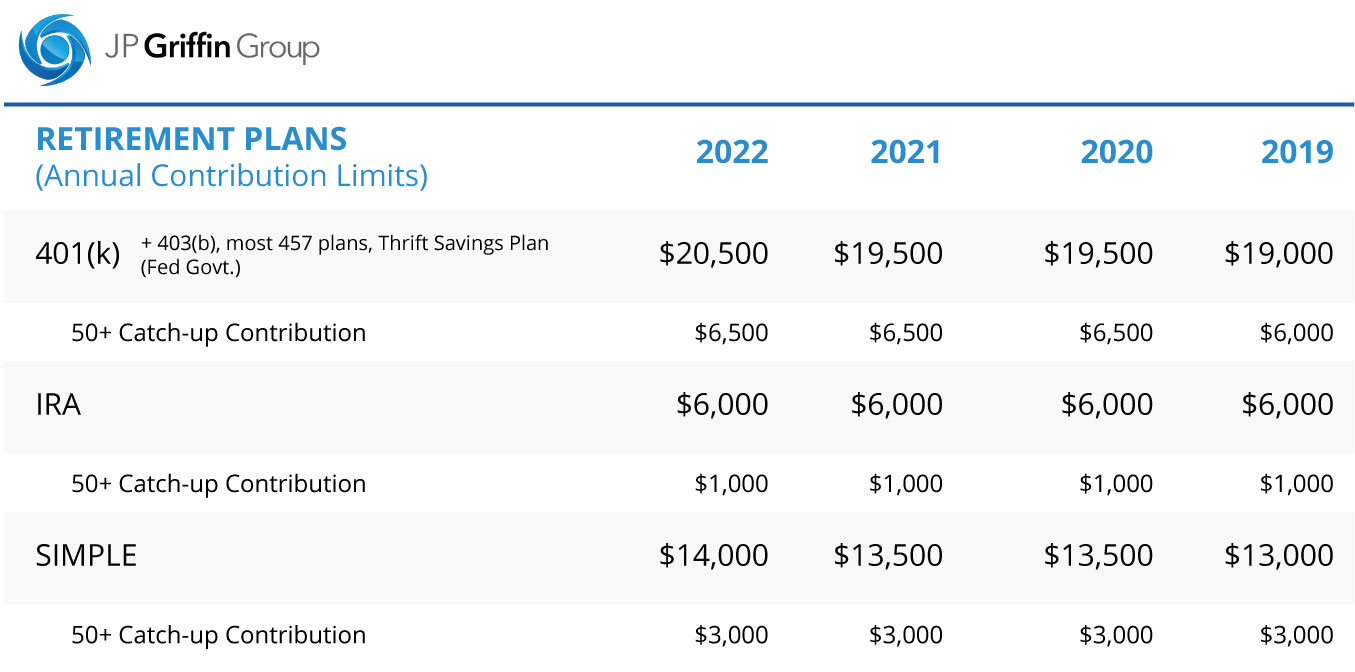

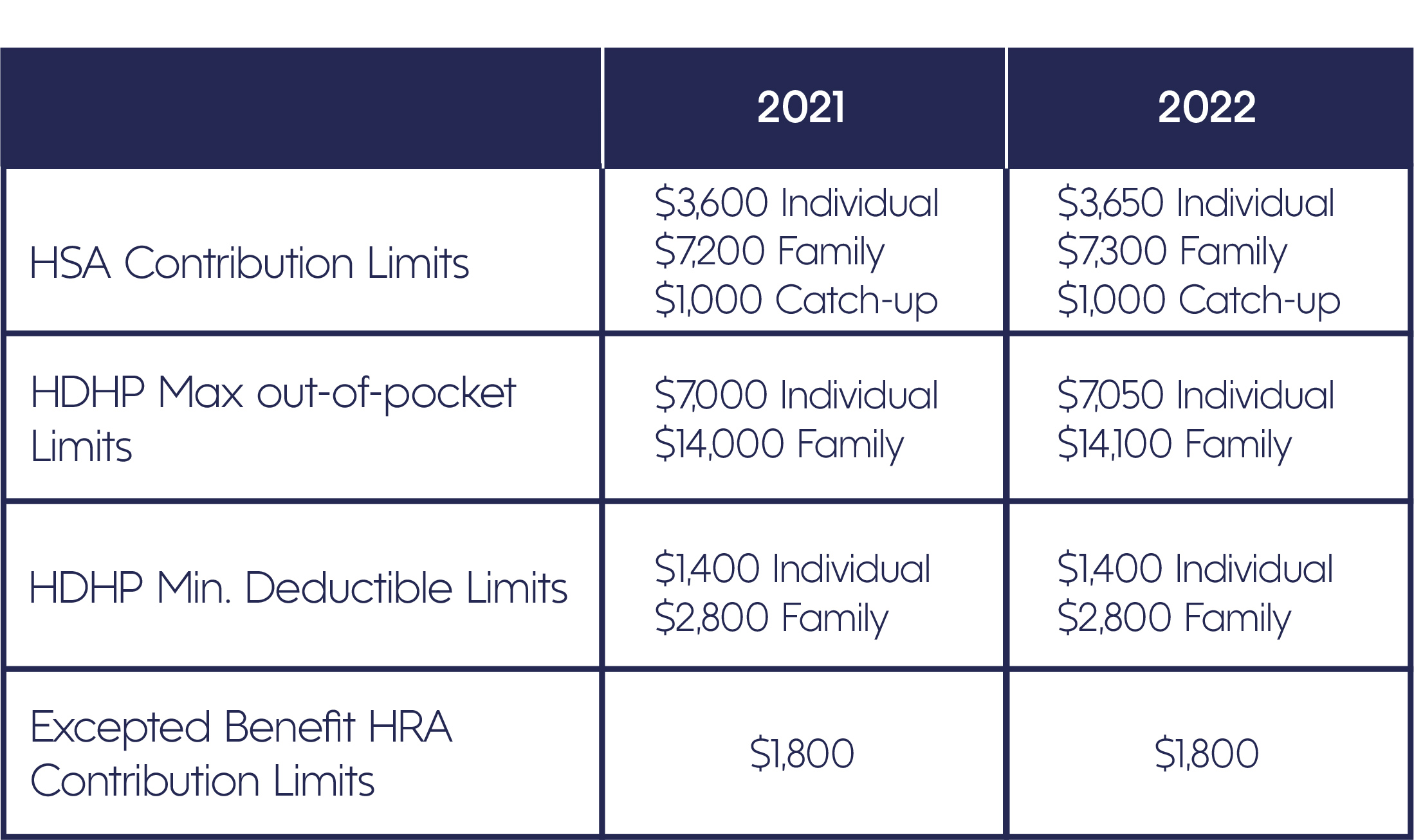

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

How A Dependent Care Flexible Spending Account Can Help Your Family Austin Benefits Group

What Is A Dependent Care Fsa Wex Inc

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

A Dependent Care Fsa Can Help You Save Money On Childcare Costs Here S What To Know

Hsa Dcap Changes For 2022 Blog Medcom Benefits

Your Flexible Spending Account Fsa Guide

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

What Is A Dependent Care Fsa Wex Inc

This Presentation Covers Ppt Download

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning